by Tara Joyce | Jul 21, 2017 | Featured, Pay What It's Worth Pricing

Money is a symbol of two basic principles that underlie every process in the physical world: the principle of value, and the principle of giving and receiving. Whether it is our money, our labor, our commitment, or our care—we estimate the value of something by what we are willing to give for it and receive from it. This respect and attention we give to what we value, and how we value it, is a reflection of our self-worth. The lack of respect we give to the things that matter to us—including our bodies and the worth of our labor—is also a reflection of our self-worth. This unconscious lack of respect is our shadow energy around money and self-worth, and commonly manifests itself as the emotions of fear and greed, which are closely tied to our modern relationship with money and wealth. The corruption, materialism, and consumerism of modern society, and the widely disproportionate difference in wealth between the people at the top of the income ladder and the rest of society are all manifestations of our collective money shadow.

Unaware of our personal shadow energy, we have “bought into” the idea that if we can afford an item, it must measure and reflect the inherent value we hold—and if another cannot, they must be worth less and hold less value than we do. Disconnected from our own and others’ true sense of worth, we are losing our intuitive sense of how much to give for the value we receive. Instead, we are building ourselves up with material accumulations, as though they alone are a reflection of our worth and deservedness. What our money shadow does not recognize however is that money is only one type of currency, one type of wealth, and it is not a true measure of our self-worth. Perceiving money as the only and/or most important measure of wealth and self-worth can only leave us feeling unsatisfied. There will always be someone with more money, and thus there will always be someone for us to feel less than. While several psychological studies have revealed that although material security definitely increases our happiness, beyond a certain income level this correlation between income and happiness drops significantly. One reason for this is that a major ingredient of happiness is a sense of sufficiency—of having enough. In a culture where we are trained to consume and to compete and compare, many of us have lost the ability to recognize this feeling of satisfaction. We find ourselves feeling we do not have enough, that we are in lack, and these feelings further trigger our shadow emotions of fear and greed. We find ourselves feeling that we are not enough.

While we may not objectively live in poverty, in essence, our culture lives with a poverty consciousness. Attached to material goods as a symbol of our self-worth, we are now better equipped to feel in lack—to feel we do not have enough and are not enough—than to feel satisfied. This lack of satisfaction, this poverty consciousness, is extremely painful and often manifests in mental habits like criticism, judgment, envy, and anger. Unaware of the pain we are in, and unable to recognize a feeling of satisfaction within our self, we unconsciously invest in scarcity—we acquire for the sake of having more and more, further losing our ability to access our inner feeling of “enough.” Lost in our greed, we endlessly chase the ever-receding prize that is our happiness.

It is not easy to feel whole and satisfied in a collective culture that sells you on your insufficiency. It requires cultivating a conscious awareness of how you behave and how you think. It involves actively looking at your attitudes and imbalances around money, authority, and health. There is a balance to be found between greed and generosity, between trusting in abundance and buying into scarcity. A healthy relationship with physical wealth can be cultivated within yourself.

photo credit: Jimi Filipovski

by Tara Joyce | Feb 24, 2016 | Cultural Creativity

Psychology is to money what an engine is to a car. Your motives — what drives you — determines your experience with it.

Increasing the quality of your thoughts, your wealth increases. In valuing yourself more, you naturally exchange this greater sense of worth with the world around you.

In building credit with yourself, you build credit in the world.

But in order to increase the quality of your thoughts around money, in order to build your credit, you first need to do the work. Your work with money, and with worth. To fully recognize and grow your credit, you need to identify the outer work and the inner work you need.

Your Outer Work with Money Includes…

- Marketing Yourself – Identifying & communicating the value you offer

- Creating Opportunities for Higher Pay – Growing your wealth

- Managing Your Money – Caring for your wealth

Your Inner Work with Money Includes…

- Transforming Your Thoughts, Feelings, Beliefs, Attitudes and Decisions About Yourself and Money – Connecting with the value you offer and the abundance of wealth you possess

In exploring both aspects of your experience with money and yourself, you’re doing the work you need to build the credit you inherently hold, and you’re supporting yourself in realizing the abundant life you deserve. Working on the quality of your thoughts, you improve the quality of your experience.

photo credit: Simon Cunningham

by Tara Joyce | Sep 11, 2015 | Cultural Creativity, Self/Business Growth

Luxury can be a trap. It can be so comfortable to live in—that it can be so very hard to leave… Hard to stretch yourself beyond the sumptuous and secure life you’ve come to know. Most of the world isn’t as comfortable as you are, and living with this truth can make it hard to leave your protective and pleasant container.

Luxury is a trap—if you let it be. For when you have the ability to live self-indulgently, you also have the ability to not challenge yourself with the realities of life. You have the means to avoid the uncomfortable and, often times, the ability to find someone else to take on their responsibility.

Money—and the power it offers—can be used and abused like anything else that affects your energy. Like drugs and alcohol, it can be an escape—a means to numb the pain. Your richness can keep you separate and shielded. It can keep you trapped—in a luxurious life.

Like you’re in the womb, the privilege of abundance provides you with the opportunity to remove yourself from the undesirable. You have the means to create a world where you do not have to deal with the uglier truths of life. Insulated and cared for, you are afforded the luxury of having a choice.

The problem with abundance is how you can trap yourself in its comfortability—keeping yourself small and shielded. Living in this gilded space, you can’t see your abundance as a thing of beauty—and a gift of grace.

Abundance is beauty. Stay mindful to the richness of your life, it’s here to expand you—but it can do the opposite. It can contract you—if you let it. This is the only true money trap—and no matter your stage of wealth—you have the choice to not fall into it.

photo credit: Mike Bitzenhofer

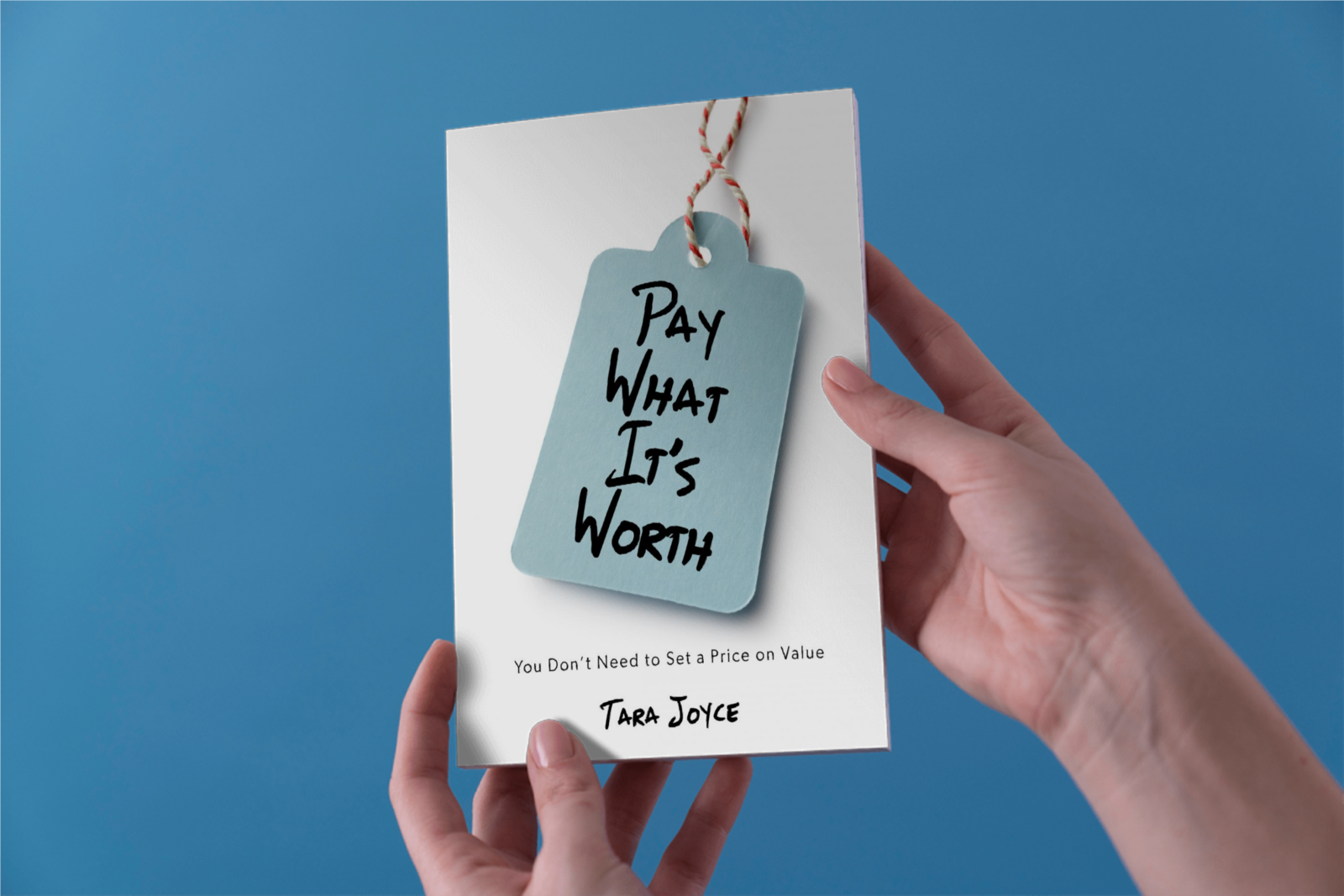

by Tara Joyce | Mar 27, 2015 | Cultural Creativity, Pay What It's Worth Pricing

Can you really know your value?

Is it a fixed thing?

Is it of value to quantify your worth?

These questions intrigue my mind.

To explore this curiosity, I developed a (business) practice of not setting prices. In this system of pricing, I place no limit on the value of my offerings, and instead I trust and guide my customers to fairly determine the value of what they’re receiving, and the price they pay for it.

In not setting a price on the value of my service, I’ve come to understand something powerful: the only real limits to your value are the ones you place on yourself.

Your value doesn’t have a limit, unless you choose for it to. It’s not a fixed thing; it changes, rises and falls, relationship-to-relationship, exchange-to-exchange, and it grows as you learn to value yourself more responsibly.

The heart of it is: your worth, and the value you place on it, sets your intentions for what you receive. You have the power to choose how limitless you truly are.

There is no need to fix or limit your value; rather there is a necessity for you to grow into your awareness of it and your boundaries around it. In my experience as you do you’ll find your world, and the value of it, grows graciously with you.

A version of this article was originally published on Fine Lines.

photo credit: Nicolas Raymond

by Tara Joyce | Oct 27, 2014 | Cultural Creativity, Pay What It's Worth Pricing

I like to think about money as an idea in the form of credit. To get in the money game, I need to build up my credit. To build up my credit, I need to work on my inner and outer relationship with my self and money.

My Outer Credit Work:

- identifying & communicating the value I offer (marketing my self and my business)

- growing my wealth (creating opportunities for higher pay and more abundance)

- caring for my wealth (managing my money and my self)

My Inner Credit Work:

- connecting with the value I offer and the abundance of wealth I possess (transforming my thoughts, feelings, beliefs, attitudes, and actions about money and my self)

As I practice with Pay What It’s Worth and not setting prices, I’m noticing the system naturally supports me in doing my inner and outer work. It supports me in clearly identifying where I still have work to do in improving the quality of my thoughts about my self and money. When I feel something isn’t working in my business and/or in an exchange with my customer, I have an opportunity for inner work and outer work. My business is a mirror for my relationship with my self and money, and my customer is a powerful guide in showing me what is working in this relationship, and what is not. My customer’s feedback and behaviour in our business exchange, and my satisfaction with it, highlights where my thoughts and actions are adding value and where they are not. How am I building my credit? How am I taking from it? If I don’t feel fairly valued, I explore how I am creating this imbalance in my relationship and I work to correct it.

Psychology is to money what an engine is to a car, and my motives, my drivers to action, determine my results. My thoughts about money determine where I go with it, the quality of my ride and my response, and how fast I travel. If I want to live and love abundantly, I must be working on thinking abundantly. As I work at increasing the quality of my thoughts, and in turn my actions, my wealth increases. As I learn to value my Self and how I am of service more wholly, my customer naturally does too. This is the work and the reward of building my credit.

photo credit: Matt Jiggens